Rolling Contracts

New Signals

Trade Management

Raise stop on long ZAR to 0.05365 at today’s low. Long signal terminated.

Forgot to roll July short positions into September. Short Wheat(July) covered at 556 3/8 and short Canola covered at 597.8

Long Hang Seng stopped out at 17882.

Long ZF closed at 106’152.

Short Rapeseed filled at 473.5 and the new stop level is 481.

Short Lumber filled at 482.5 and the new stop level is 495.

Short positions need to be rolled forward as well when approaching first notice day. This is a trading error. Will re-enter at market should there be triggers on short Canola and short Wheat.

In drawdown, GET SMALLER.

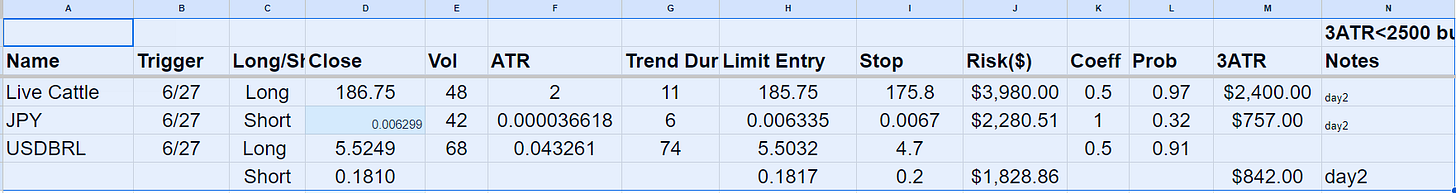

New orders: short JPY, short BRE and long Live Cattle

Goal Setting

Reset into strength.

Anticipate sharp pull back when we are at full margin(>80%). Actively reduce exposure to prepare for the pull back.(Portfolio Level): take loss on losing positions immediately; raise stops on winning positions to the low of the day and keep adjusting on daily basis; cancel pending open orders. No new trade till exposure gets down to manageable level.

DX>55 for three consecutive days, enable profit taking. The first down day(IBS<0.5) setups the event. Use the lower of the low of setup day and the next day(trigger) low as the stop level.

Review contracts every Friday and roll positions into the next lead contract(higher trading volume than current position) on Monday.